Hello crypto traders. In the last video, I taught you how to create Short and Simple bots on 3Сommas. And now, we will talk about Composite and Composite Short Bots, and how they differ from Short and Simple bots. Of course, the Composite and Composite Short Bots are more difficult to set up, but it’s these bots that have the most powerful functionality and the highest profitability. Therefore, they should definitely be used. Let’s start.

Creating Composite and Composite Short bots on 3commas

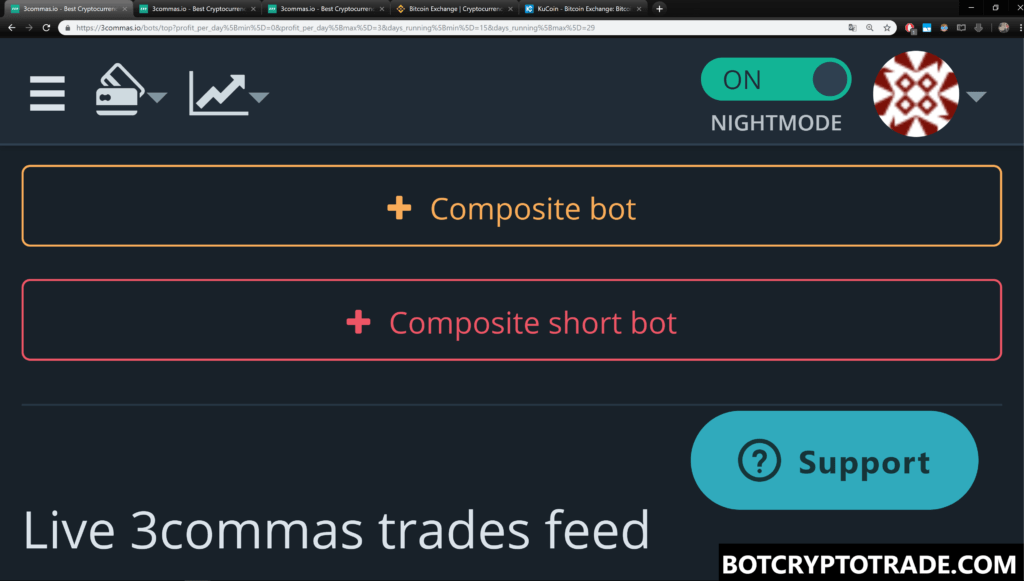

You can create a new Short bot on the “Bots” or “My Bots” pages. To do this, click on the “+ Composite bot” or “+ Composite short bot” buttons. Creating a Composite bot is similar to creating a Simple bot, but the first type is somewhat more complicated and has more settings. Composite and Composite Short bots have more opportunities for profitable cryptocurrency trading. Composite bots are only available at the “Pro” tariff, which is the plan that provides the best tools for maximum earnings.

What is the difference between a Simple bot and a Composite bot on 3commas?

1. The number of active deals

The main difference between Simple and Composite robots is the ability to simultaneously open multiple deals on several coins. A Simple bot can trade only one crypto coin at a time. For example, if you create a new bot, a pair of BTC_LTC, then it will always trade only this pair when it begins.

Composite bots have the ability to trade many different pairs at the same time. For example, you can select the pair BTC_ETH, BTC_LTC, BTC_TNT, or more, then after—if the conditions for buying are confirmed—the deal will be opened at the same time for all these three pairs. If the condition is confirmed only for one pair, then the deal will only open for that one pair, and other pairs will wait for a buy signal.

2. Optimal using of funds on deposit by bots

The Composite bot allows you to more optimally use the funds of your deposit: it will use all the money allocated only for the perspective coins at the current moment. A Simple bot is deprived of this advantage since after a run it will wait for a buy signal and the funds will just be frozen.

Simple bots do not take care of funds, which already being used for working bots. If you run a lot of Simple bots many open deals, you won’t know what the available amount on your deposit is, then there will suddenly be a deficit of funds and errors amongst the working bots.

For example, there are 10 pairs that inspire confidence, and the trader has a desire to run bots with all of those pairs. However, there is one “problem”, his deposit will only be enough for 2 deals at the same time—if we consider the probability of the execution of all safety orders. And you won’t be able to tell, in this case, which crypto coins will receive the first signal to buy.

If you create 10 simple bots for each trading pair, run them and after a while, the signals eventually purchase 5 crypto coins, that cryptocurrency will be bought without any problem. However, in the case of falling coins and the execution of safety orders, there will not be enough funds on the deposit for them, so this is the reason why deals will not be able to work normally, which can lead to some losses.

In this case, you can create a Composite bot for 10 pairs, set up the maximum number of active deals to 2, and the bot will buy the first 2 crypto coins which triggers the signal.

New deals will be open only under the condition that one of these two opened deals have already been completed and—as there will never be more than 2 deals—there will be no deficit of funds in your deposit.

3. Terms at the beginning of the deal

Simple bot only allows for:

If you run it manually, the trader has to do things manually and should run the deal at a convenient time, which suits them. After closing a deal, a new one deal will not open.

If you run it automatically, you have to open the deal by yourself for the first time, but after that, the bot will open the deal for you. After closing the deal, a new one will be opened immediately.

Both Simple and Composite bots allow for:

TradingView Signal Buy or Strong Buy—the opening of the deal will signal “Buy” or “Strong Buy” from the trading pair in the TradingView signals. After closing the deal, a new deal will be opened, provided that the signal is saved or is known to appear in the future.

TradingView Signal Strong Buy—almost everything is the same, as in the previous method, except that the signal must be “Strong Buy”.

4. Easy management and statistics for Composite bots

Composite bots are easier to manage and collect information on. For example, on the composite bot page you can:

Close or cancel all deals, with just one click;

See information on active and closed deals;

Edit the Composite bot and change the parameters for all new deals, for all trading pairs;

Simultaneously edit and reduce the number of active deals in case of deficit in deposit funds.

That’s all. In this video, you learned how to create Composite and Composite Short bots on 3Сommas, also I taught you the differences between Shorts and Simple bots. In the next video, I will show you how you can copy successful deals and the settings of bots used by professional traders. You will only need to make a couple clicks in 2 minutes and you will receive a ready-made successful strategy. Find it interesting? Watch the following video.