Hello traders. The topic of this video is trading crypto futures at 3commas. I will talk about the benefits of futures in general, and what tools 3commas offers for trading cryptocurrency in the Futures market. Also, a few words will be about how this market differs from the margin market. Let’s start!

Advantages of trading crypto futures

Trading crypto futures has the following benefits. 1) Trade for the falling coins or Short deals. I have already told about Short deals in one of the previous videos that this type of trading is possible only with leverage. Binance Futures or Bitmex provide such leverage from x1 to x125. At the same time, on Binance Futures, in addition to Bitcoin and the other 5 top cryptocurrencies, there are many more altcoins offered for trading both for Long and Short positions.

2) As mentioned above, futures provide an opportunity to trade with leverage. That is, traders can open deals that exceed their deposit. For example, using just 100 USDT and taking x100 leverage, you will be able to open a trade for 10,000 dollars. 3) Risk management and hedging is one of the reasons for the creation of the Futures market. For example, you buy Bitcoin at 9,000 USDT with x1 leverage and keeps it on his deposit.

It’s like a long-term Long, without the risk of getting Liquidation and without leverage (x1). But it is not a fact that the token you have chosen will start growing. Therefore, for the remaining amount, you can make a Short deal in case if Bitcoin will fall with leverage, for example, x10. This is the so-called hedging of the Long position – with x10 leverage on the Short position, you will recover the losses from the Long position. However, everything is simple in words, but in real trading everything is different, so assess all the risks yourself.

SmartTrade for trading crypto Futures

SmartTrade is a special terminal 3commas for manual cryptocurrency trading, for the Futures market it differs from the Spot market. The following instruments are available to use on the Spot market. Buy / Sell (simple buy or sell of tokens without targets), Smart Trade (buy coins and then sell them with Take Profit), Smart Sell (sell coins that you already have with Take Profit), Smart Cover (sell and buy back cheaper crypto), Smart Buy (buy cheaper coins that you sold before).

For the futures market, the instruments are slightly different. Buy / Sell (simple buy or sell tokens without targets), Smart Long (buy coins and then sell them with Take Profit), Smart Sell (sell coins that you already have with Take Profit), Smart Short (borrowing from the exchange, sell and buy cheaper crypto), Smart Buy (buy cheaper coins that you sold before).

You may be confused about the difference between Short and Long positions, as well as buy back coins. I talked about this in detail in the video “Short cryptocurrency”. As well as for the Spot market, SmartTrade Futures have such instruments as Trailing Take Profit, Trailing Stop Loss, Stop Loss Timeout, Split Targets, Conditional Orders (such orders are not visible in the Order Book). And of course, in the 3commas terminal, you can specify an isolated or cross leverage for the desired coin.

Futures and Margin markets crypto

As for Margin trading on Binance or another exchange, this is the same Spot market, but with leverage usually from x3 to x10. The point is that you borrow from the exchange in the required amount of cryptocurrency, and in return give your USDT. And during the execution of deals, while you have borrowed funds, the exchange deducts a commission from you.

It is possible to open Short positions, but the limited leverage and lack of hedging compared to the Futures market make itself felt. Therefore, I recommend either trading on the Spot market without leverage, and if leverage and Short positions are needed, then it is better to choose the Futures market. In addition, there is much more liquidity in the Futures market compared to the Spot market, that is, more traders now prefer futures rather than a spot.

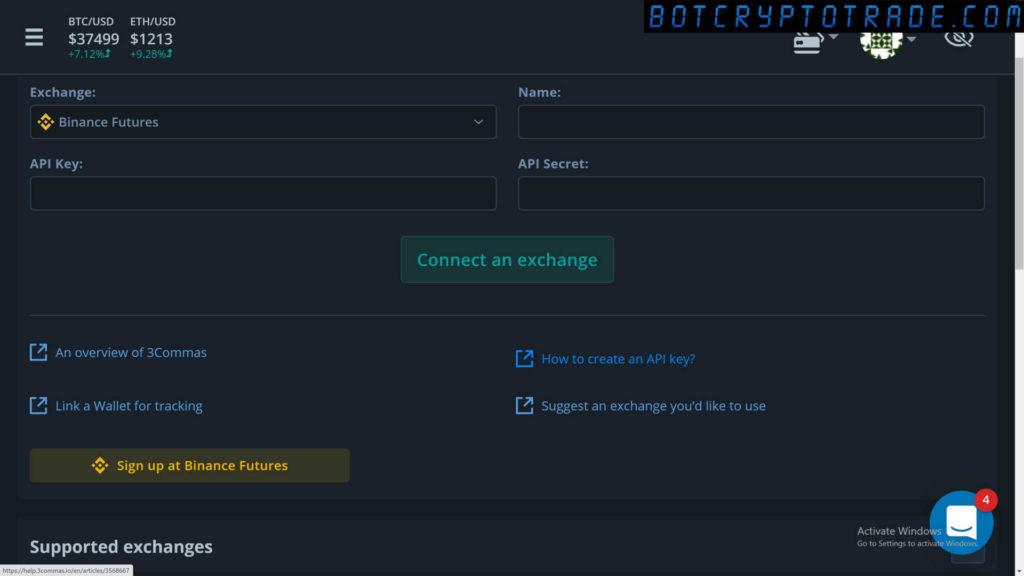

And, of course, 3commas bots work in the Futures market. They are set up and work the same as in the Spot market, but with some peculiarities. Botcrytotrade.com has a separate video about “Futures Bots” and “Bots for Bitmex”, in which I talk in detail about bots for trading with leverage. How to connect Futures and Margin account to 3commas also have separate video.

In this video, I talked about trading crypto Futures at 3commas. This platform has all the necessary tools for manual and automatic trading of cryptocurrency with leverage. You can specify any settings, connect signals, open both Long and Short positions at the same time in order to make the most of the crypto. This video is over and we will see you in the next video releases at botcryptotrade.com