Hello traders. In one of the previous videos about “Binance Options”, I have already said what crypto options are, where and how they should be traded. However, bots for trading crypto options have not existed for a long time, and at the end of 2020, they now appeared and are available on 3commas. Let’s start studying them and find out how they work!

Option bot what is it?

Let me remind you that an Option is a financial derivative of a particular cryptocurrency, for example, Bitcoin. This is a contract between the seller and the buyer, where the seller must sell or buy an asset at the request of the buyer, who, during the transaction, must pay the seller an option premium – a certain amount from the contract.

The buyer gets the right but is not obligated to sell or buy coins at a previously agreed price on a specific date before the end of the contract. In the 3commas Option bots, many cryptocurrencies are available for sale or purchase and 4 types of transactions are possible: Buy Call Option, Buy Put Option, Write (Sell) Call Option, Write (Sell) Put Option.

At the same time, there are only two basic options. Put Option and Call Option. A put option is a sale, which gives the buyer the right to sell an asset at a specific price. A Call option is a purchase that gives the buyer the right to buy an asset at a specific price. 3commas option bots provide great trading opportunities thanks to 4 types of transactions.

The strategy of trading option bots

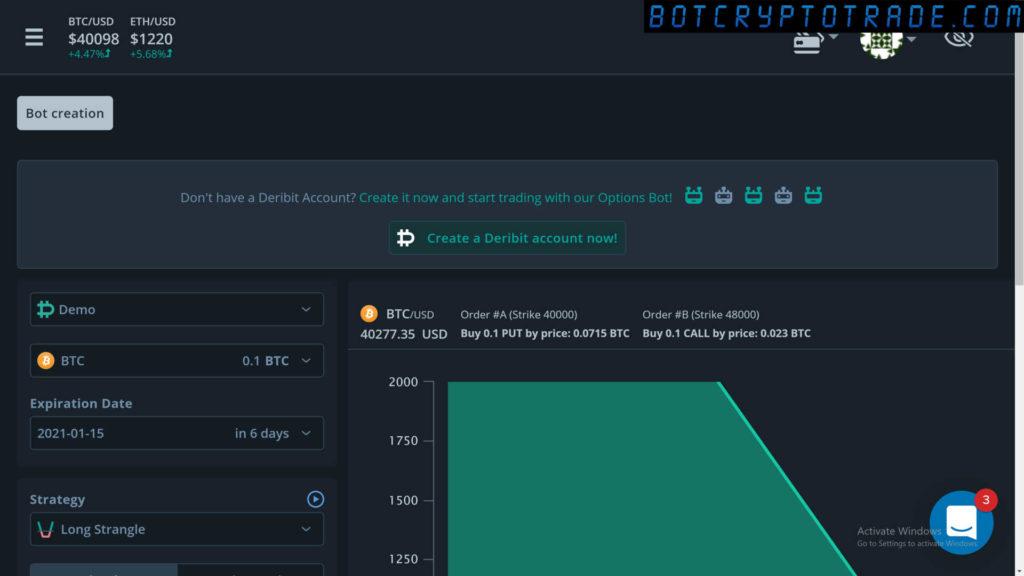

True, this type of trading is somewhat difficult for beginners and is more suitable for professional traders. Fortunately, all possible strategies are included in the 3commas option bots. The effectiveness of these strategies is assessed on the chart in the terminal of the site, section “Option bot”. The price of the base cryptocurrency is set horizontally, and the loss or profit of the option strategy is set vertically. The following strategies are available.

1) Long Put. Has unlimited potential profit if things go well and limited loss when the underlying coin stands still or rises. It is used when an increase in volatility and a fall in the value of the underlying token is expected. 2) Long Col. Also represents an easy and well-known strategy. It is used when an increase in volatility and an increase in the value of the underlying token is expected. It is the opposite of Long Put.

3) Bullish Call Spread. It is usually used in a growing market if the trader believes that the price of the underlying cryptocurrency will rise. There is an analog of the Bullish Put Spread, which is produced on Put contracts, the choice is made based on the price of each type of contract. Bullish Call Spreads compared to Long Calls give more profitable trades at a similar price level.

Benefits of trading by Option bots

4) Bearish Call Spread. Used in a falling market if a trader believes that the price of the underlying coin will fall. This strategy is implemented by buying or selling Call options with different strike prices, but one expiration date. There is an analog of Bearish Put Spread, which is produced on Call Contracts.

When making a choice between Call and Put contracts, one should take into account the situation in the crypto market for maximum profit. Other popular strategies: 5) Bearish Put Spread. 6) Bullish Put Spread. 7) Selling a butterfly (Short Butterfly). 8) Buying a Long Butterfly. 8) Sale of the condor. 9) Buying a condor. 10) Strap. 11) Buying a strangle. 12) Strip. 13) Buying a straddle. 14) Proportional Reverse Put Spread. 15) Proportional Reverse Call Spread

As you can see, there are at least 15 types of strategies that are important to be able to use and have experience. It will be difficult for a beginner without knowledge and skills to trade options in the cryptocurrency market. This is far from a Spot market, where it will be possible to hold a position for a long time in the hope of making a profit. 3commas has simplified this process with automated algorithms and offers a quality optional robot for PC and mobile devices.

The 3commas bot option has a user-friendly interface that anyone can configure in five clicks. You can track a loss or profit right during trading. The purchase size is calculated automatically based on the data specified by the trader and the current market situation. In this case, any positions can be closed for a long time. And yet – this option bot helps to test the effectiveness of the current strategy at one point or another.

The video about the 3commas cryptocurrency bot option is coming to the end. In fact, there are simply no other analogs for automatic options trading in the electronic money market. Therefore, if you have been looking for option bots for a long time, try them first in the demo mode in the system, test the strategies, and then draw the appropriate conclusions. The video is complete and keeps in touch till the new videos on botcryptotrade.com