Good day friends. In this video, I want to talk about the Order Book in the cryptocurrency market, that is, a table with orders for the sell and buy of tokens. With this tool, a trader is able to assess the amount of supply and demand, analyze the liquidity of a coin in order to make a final decision – to open a deal for buy/sell or not? Here we go!

What is it Order Book in crypto?

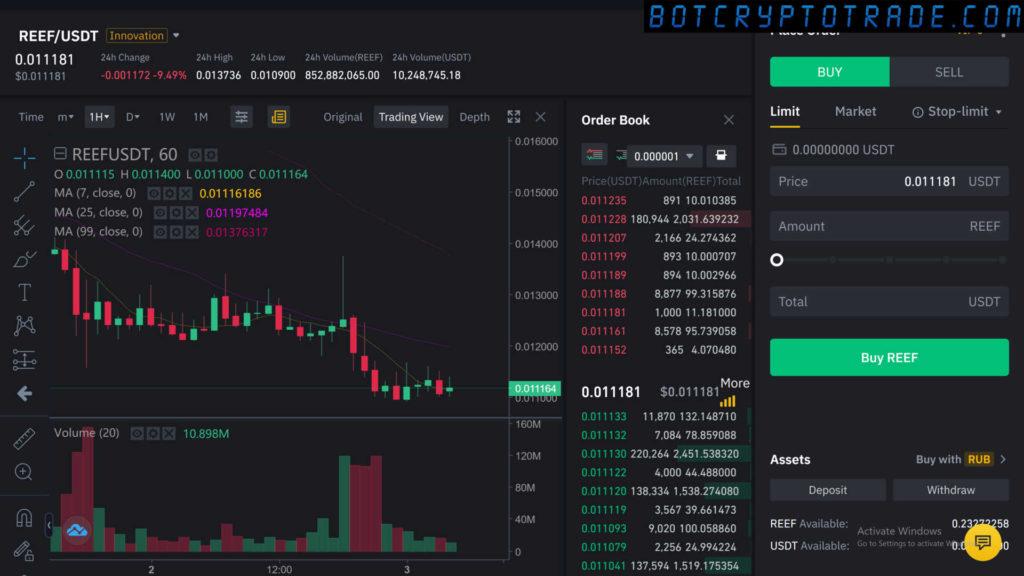

The Order Book (Market Depth) in cryptocurrencies is a show of the prices that traders have set in the form of Limit Sell and Buy Orders at the present time. The Order Book is presented as a three-column table. Firstly, orders to sell or buy tokens (quotation) are shown in real-time. Secondly, the number (volume) of all tokens. And thirdly, the cost of the entire volume of the coins.

At the same time, Market Orders (active) are not shown in this table, since a trader may want to buy or sell suddenly at the Market at any available price. Limit Orders (passive) are essentially like planned orders that just fall into the Order Book. To create a deal, the merchant places an order indicating the values of the future deal: buy or sell, as well as the desired price and the required volume of the coin.

The transaction will be executed only if the crypto exchange finds a counter order that meets the requirements specified in the order. For example, a trader placed a Limit Order to sell 1 BTC at a price of 9000 USDT, therefore, the exchange must find a counter-order from another trader who created a Limit Order to buy 1 BTC at a price of 9000 USDT.

If a counter order was immediately detected for the first order, the deal is executed instantly. When there is no such order, this Limit Order enters the Order Book and starts being displayed there, waiting for a counter order. Such an Order may remain on the trading table for a long time before being executed or not executed at all. If it is not executed, the merchant cancels it or continues to wait for some more time.

How to use the Order Book?

It all depends on many parameters, such as the current price of the token, the volume traded, and the interest in this pair from other traders. The prices in the Market Order are sorted into three columns. In the first, in the decreasing order of the “Ask” price, and in the second in the increasing order and approaching the equilibrium “Bid” price. And in the third, when the Bid and Ask prices come to the same value, the deal will be executed.

By the way, about Ask, Bid, and Last prices, we had a corresponding video and article. The difference between the bestseller prices and the best buy prices is called Spread. The Spread Size changes depending on the sentiment in the market – the current trend, volume, news, popularity, or novelty of the current coin.

The trader, if desired, uses the Depth of Market as one of the tools in technical analysis. After all, with its help, it will be possible to see the maximum and minimum restrictions within which the price of the selected cryptocurrency can be moved. Usually, Limit Orders, which the trader sees larger than Market Orders, so have a stronger influence on the change in the price of coins. And this is very useful information for a trader!

For example, if someone has created a large order to buy Bitcoin or several ordinary orders, but they are in the Order Book for a long time and are not executed. The owners of these orders cancel them, unable to bear it. This indicates the demand for Bitcoin at the current time and the prospects for its price growth. The Depth of Market helps traders find entry and exit points from trades (buy and sell at the desired price) and set Take Profit and Stop Loss wherever they need it.

Software for working with Order Book

It should keep in mind that some traders abuse the Order Book. Let’s say they place a false order and force the market to go in the direction they want. And when this happens, they cancel their Limit Order and place a new opposite Limit Order or even make a large buy or sell in the Market. As a result, these players make big profits, and most other people lose money.

Unfortunately, an ordinary Market Order on any crypto exchange is not very informative, and therefore of little use. To get the best effect from the Order Book, it is recommended to use special programs. Such software cannot be found in the public domain, it is difficult to create it yourself, and ordering is very expensive. Therefore, the most suitable option is to use the ATAS platform, which has all the necessary tools for working with the Order Book.

Namely: 1) Smart Tape – completed market orders, selected from the entire Depth of Market. 2) Bid / Ask price tape – an opportunity to see the trading volumes that have passed through Bid and Ask while the price is moving. 3) All prices – a special counter for filtering volumes by prices to find the best support and resistance levels.

4) Smart Order Book (Smart Dom) – an improved version of the ordinary Order Book on the crypto exchange, which allows you to find large orders in the Order Book, study its full depth and find special spoofing algorithms. 5) Cluster and tick charts – as an additional tool for improved technical analysis.

ATAS tools, in comparison with the usual Order Book, show more detailed and deep data of the market at the current time. This, in turn, makes it possible to filter small, medium, and large Limit Orders in order of importance and in a visual form. In addition, the ATAS platform will save you from false orders from large players and help you more accurately understand what they want to do and how they will behave in the future.

The video about the Order Book is complete. I was told you what is it, how to use it, and its main aspects. Unfortunately, the Depth of Market on a crypto exchange, be it Binance or even the bot trading site 3commas, is not very informative. Therefore, if you want to trade more efficiently, it is better to use an additional tool, such as the ATAS platform. That’s all and see you in new videos on botcryptotrade.com