Greetings friends. In this video, I want to talk about the important topic of trading not only cryptocurrency but also Forex and Stocks. What the professional traders use, and beginners don’t even know about it. Interesting, huh? These are trading volumes. By studying and understand volumes, you are more likely to know what the big players in the crypto market are going to do. And this, in turn, will allow you to find more profitable open and close trades. Let’s start.

What are the volumes in cryptocurrencies for?

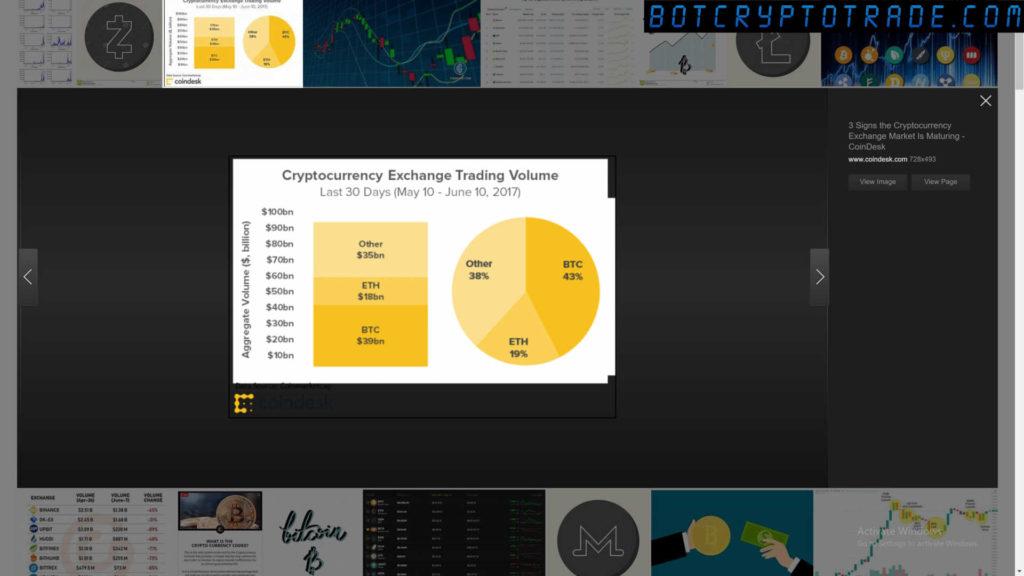

The volume of trading in the cryptocurrency market is, in other words, the amount of money that appears on a particular pair. For example, if a big amount of money comes in the USDT_BTC pair, then more USDT is given for Bitcoin, and BTC begins to grow. This is the time to open a Long position, to buy Bitcoin, and sell it in the future.

Conversely, if the volume of Bitcoin falls in the USDT_BTC pair, then the BTC price begins to fall. This is the time to open a Short position, fix Long and sell the Bitcoin, or wait for the coin to fall more to buy cheaper. Volumes are used in technical analysis by experienced traders to enter the market, set Take Profits, and set Stop Loss.

Big players (whales) like to do deceptions and the Stop Loss of ordinary traders are often knocked out. The market is driven by big money. Therefore, it is important to know when the whales come in with their money and when they leave, when they buy and sell. We must act together with them.VSA (Volume spread analysis) is an analysis of the volume of trades, as well as the size and shape of candles.

How to use volumes in crypto

When analyzing VSA, you need to understand and see the whole situation of the market. We compare the volume by candlesticks that in past and now. There are 2 types of volume: 1. Bullish volume is characterized by an increase in volume on up bars and a decline on down bars. 2. Bearish volume is characterized by an increase in volume on down bars and a decrease on up bars. The strength of the market manifests itself in bearish candles. They don’t sell.

The weakness of the market manifests itself in bullish candles, that is, they do not buy. It is important to pay attention to the phrase accumulation (buying) and distribution (selling). The whales enter into their deals or do not exit immediately. In order not to cause a sharp movement in prices, they enter in parts, in stages. The buy/sell climax is an imbalance between supply and demand, leading to a market reversal.

Usually, special indicators and tools are used to determine the volumes. The most useful indicators are the following: Heatmap Volume, Delta Volume Weighted – Intraday, Volume Oscillator, Volume spread for VSA, and many others. They can be found on the TradingView website and then connected to 3commas for manual or automated bot trading.

Analysis tools for VSA volumes in cryptocurrencies

Of the useful tools, I highly recommend using the ATAS service. A detailed description can be found in the material – ATAS Review. This service offers professional tick, spread, cluster, and many other charts for in-depth analysis of volumes in the cryptocurrency market.

This service also has other tools for analyzing BCA volumes. These are Smart Tape – actual market orders, specially selected from the entire order book. This allows you to see what other big traders are doing on the market with different capitalization at any time. Bid/Ask Tape – an opportunity to see the trading volumes that have passed through asks and bids during the price movement.

All price – is a special counter for placing volumes at prices. Helps to find good levels of resistance and support. Smart Dom – an improved version of the order book, helps to highlight large orders in the order book, its full depth, and calculate special spoofing algorithms. In addition, ATAS offers its own unique indicators for analyzing volumes in the crypto market, which are not available in TradingView.

Our video about cryptocurrency volumes is finished. Volume analysis is an indispensable element of a trading strategy, as a starting point for opening and closing deals. It doesn’t matter if you play Long or Short. It is important to be able to follow the trend with the big market players, not against them. Only in this case, success in investment and trading in the crypto market is ensured. That’s all and see you in the next videos on botcryptotrade.com